Dealing with Medical Debt After a Serious Injury

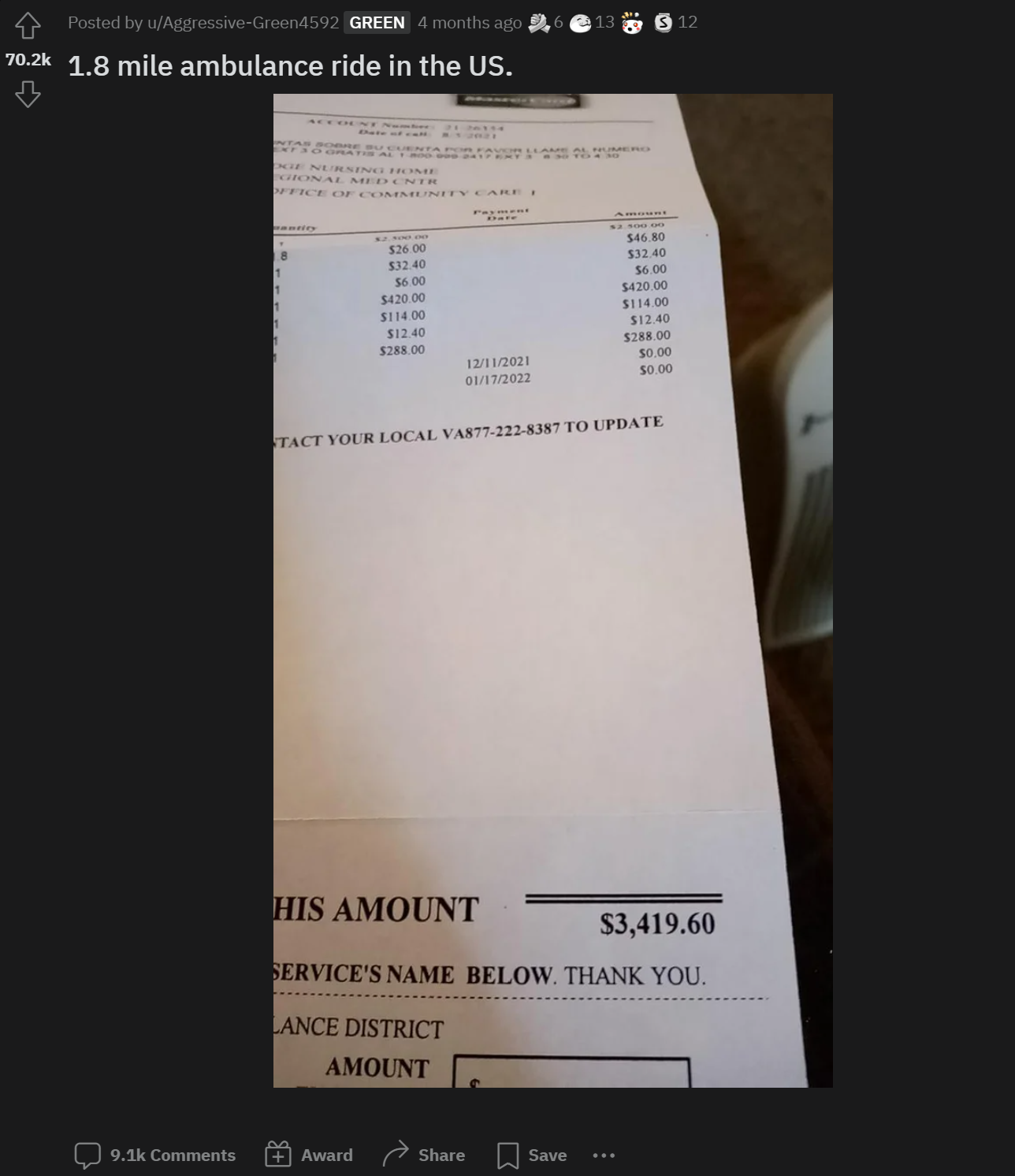

A CNBC article revealed that 58% of Americans in 2022 live paycheck to paycheck. However, paychecks do not stretch as far with high inflation, and unexpected medical bills can devastate a person’s finances. For example, a user on Reddit shared a “mildly infuriating” experience of receiving a $3,419 invoice for a 1.8-mile ambulance ride.

Serious injuries add enough stress to people’s lives, and medical bills only amplify the stress. For example, a client told me he returned to work a month after suffering multiple gunshot wounds. He explained that his medical bills would be over $300,000, and he could not afford to take any more time off. Often, injury victims forego treatment and rest because of stress about medical bills.

Because medical bills can devastate finances and cause enormous stress, it is vital to understand how to deal with medical bills after an injury. What happens if the bills are not paid? What happens to the debt during litigation? What happens to debt when someone dies? What if I can’t afford to pay the debt?

-

What Happens if Medical Bills Are Not Paid?

After several months, outstanding medical bills will usually be sold to a debt collection agency. The debt collection agency will attempt to collect the debt, and the missed payments may begin showing up on your credit report. The Fair Debt Collection Practices Act (FDCPA) allows debt collection agencies to contact debtors through phone calls, letters, text messages, and social media. They can even contact family members or friends to find out where you live. If unsuccessful in collecting the debt, the debt collection agency might sell the debt to another collection agency or file a lawsuit against the debtor. According to a 2017 report, 15% of Americans who were contacted by a debt collector about debt were sued. Lawsuits for old debt are the most common type of lawsuit in America. After being served with a lawsuit, many debtors agree to a payment plan with the collection agency, sign up for debt consolidation, or file bankruptcy.

When a person files for bankruptcy, they are granted an automatic stay. An automatic stay prevents creditors from contacting you. Bankruptcy may eliminate some or all of the debt. Consultations with bankruptcy attorneys are usually free, so speaking with a local bankruptcy attorney might be a good idea if collection agencies contact you. If a debtor fails to file bankruptcy or agree to a payment plan with the collection agency, the agency may get a judgment against the debtor. A judgment is a court order that allows a creditor to have more potent tools, such as garnishment, to collect the debt. With a judgment, a creditor can attempt to garnish wages, garnish bank accounts, or seize assets.

On Last Week Tonight, John Oliver provided one of the best explanations of how collection agencies operate. (Warning: this video contains strong language)

2. What Happens to Debt During Litigation?

Medical Liens

Health insurance often pays for all or part of the hospital and medical bills after an injury. In addition, the health insurance company may seek reimbursement from a personal injury settlement, judgment, or award. This claim is called a medical lien. A medical lien is a claim your health insurance company has on any money you may receive from a third party. Medical lien claims generally have priority and are paid out of settlement proceeds before anyone else. For example, health insurance pays $25,000 for Tom’s medical bills following a car accident. If Tom’s personal injury case settles for $50,000, the health insurance company will claim $25,000 as a medical lien. That leaves $25,000 for Tom, the attorney fee, and additional costs. Sometimes, an attorney is able to negotiate down the debt, leaving more money for the client.

Debt Collection

The Statute of Limitations for bringing a personal injury lawsuit could be anywhere from one year to ten years, depending on the state and type of claim. Depending on how long it takes to bring the claim, some people find themselves contacted by debt collectors before or during litigation. If an attorney represents you on the debt, a debt collector can only communicate with your attorney. Give the debt collector your attorney’s phone number and notify your attorney of the collection attempts. Your attorney will communicate with the debt collection agency and negotiate payment from the settlement, judgment, or award. Continue to inform your attorney of any correspondence you receive from a debt collection agency. The FDCPA governs debt collection and protects debtors from harassment.

More Questions and Resources

How to Negotiate Medical and Hospital Bills?

Should I File for Bankruptcy if I Have Medical Bills?

How to Verify that a Debt is Legitimate?

What Happens to Medical Debt When Someone Dies?

How to Avoid Debt Consolidation Scams? Many debtors sign up with debt settlement firms. Debtors make monthly payments to the consolidation firms, and the firms negotiate with the creditors to settle the debt. Be wary of this option. There is no guarantee that the debt will be settled for less.

Some federal incomes, such as Social Security, Social Security Disability, and pensions, may be protected from debt collection. If you have Federally protected income, HELPS Nonprofit Law Firm (Phone: 855-435-7787) can educate you on your rights as a debtor with protected income and stop harassment from debt collectors.